Finance Classes at School – A New Trend?

“Beware of little expenses; a small leak will sink a great ship.” – Benjamin Franklin

By: Kirsten Brooker | June 20, 2022 | 461 Words

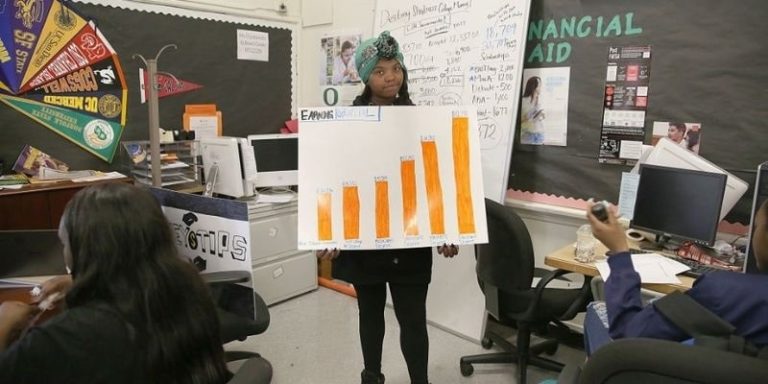

(Photo By Liz Hafalia/The San Francisco Chronicle via Getty Images)

How much do young people need to know about money? When kids grow up they need to deal with finances, including how to manage the money they make. A lot of adults in the United States and around the world struggle to keep their finances in good order – is the solution to start learning at a younger age?

The world of finance includes banking, student loans, home mortgages, and everything in between. As a result, schools around the nation are starting to help students understand this sometimes confusing and overwhelming subject. About one third of US states have begun adding personal finance classes into the school curriculum.

Preparation for Adulthood

High school is meant to prepare students for life as adults. Many essential life skills, such as how to change a tire or manage money, have not been a part of the school curriculum for decades. However, several states in the US are now saying it’s important to teach young adults the ins and outs of money.

Michigan is the latest state to approve a bill that would require high school pupils to take a finance course. The next step is for Governor Gretchen Whitmer to sign the new legislation.

is the latest state to approve a bill that would require high school pupils to take a finance course. The next step is for Governor Gretchen Whitmer to sign the new legislation.

The course will include lessons about saving money, investing, repaying loans, and even planning for retirement. State officials hope to see improvements in how the students manage their money and prepare for every stage of life. Research shows that similar classes have already proven beneficial.

Carly Urban from Montana State University said, “[The class] improves credit scores by age 22.” A credit score tells banks and other groups how reliable you are at repaying money you have borrowed – a good score is needed in lots of situations, from renting an apartment to improving your cell phone deal. She added that the students go on to repay college loans more easily, and they also borrow less money in other areas of life.

A Popular Trend

“At the most fundamental level, a high school education must prepare students for adult life. Personal finance should be part of that … A financial literacy class will familiarize students with key financial concepts, helping them understand how to handle their personal budgets,” said Michigan state Rep. Diana Farrington.

Fourteen states have mandated finance classes, but the exact details differ. For example, the program is required for 11th and 12th-year students in Georgia. However, in Ohio, ninth graders are allowed to join. The other states that require a finance class are Alabama, Florida, Iowa, Michigan, Mississippi, Missouri, Nebraska, North Carolina, Rhode Island, Tennessee, Virginia, and Utah.

Do you think personal finance is an important topic to learn and understand before becoming an adult?