Taxation: What is it?

By: Andrew Moran | September 19, 2019 | 442 Words

(Photo Illustration by Scott Olson/Getty Images)

A day does not go by where taxes are not in the news. This public policy remains a crucial issue, but to grasp this subject, it is important to understand what taxes are.

Taxes: A Primer

So, what exactly is taxation?

Taxes are money that each individual, business, or organization has to give to the government. Different taxes are charged by federal, state, and local governments. The money is spent on roads, education, transit, libraries, military, and other goods and services used by the public.

Taxes are collected by the Internal Revenue Service (IRS). If citizens refuse to pay their taxes, then it is punishable by law through a fine or imprisonment – or both.

Common Forms of Taxation

Across the United States, there are hundreds, if not thousands, of different taxes. These charges can cover everything from your family’s income to your trip to the movie theater.

Taxes are also applied at various rates. So, in the US, you may have a different tax bill depending on your income. For example, a single person earning between $9,701 and $39,475 will be taxed at a 12% rate. But a married couple earning $160,726 to $204,100 will pay a rate of 32%.

Every area in the US has its own tax structure. When you are moving to another state, it is important to study what the tax situation is like.

A Brief History of Taxation in America

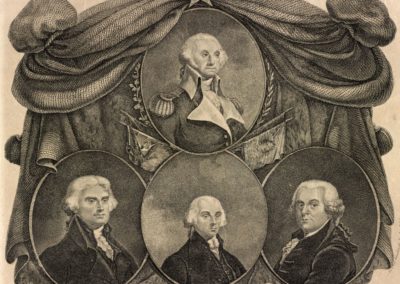

Stamp Act of 1765 imposed direct tax by British Government on American colonies. It required London-produced stamped paper to be used for various printed materials and met with fierce resistance. (Photo by Culture Club/Getty Images)

Following the American Revolution, the United States needed money to fund the government. The federal government imposed taxes on glass windows and other items. Different areas collected property taxes on land and commercial buildings.

At the turn of the 20th century, the country started experiencing a change in the tax code. States introduced sales and inheritance taxes. In 1913, everything changed with the 16th Amendment and the introduction of income tax:

“The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

The Tax System

Everyone has their own opinion on the tax system. On the left, to quote Supreme Court Justice Oliver Wendell Holmes, “Taxes are what we pay for a civilized society.” On the right, taxes should be as low as possible. For libertarians, the tax code should be scrapped and the IRS should be abolished. Where do you stand on the issue? High, low, or none at all?