Beef Prices Just Jumped Over the Moon: Here’s Why

A few pennies along the way to the market equal bloated food budgets in 2024.

By: GenZ Staff | February 21, 2024 | 886 Words

(Photo by Liu Guanguan/China News Service/VCG via Getty Images)

Live cattle prices are racing for the sky, up nearly 12% in the previous two months. Most forecasts predict increasingly high beef prices in 2024 as ranchers strive to rebuild herds depleted by the double whammy of drought and the COVID-19 pandemic. As farmers rally across Europe and American consumers helplessly watch their grocery bills soar, food prices are likely to continue their rise. This is especially true for beef, and here’s why.

An increase of a few pennies per pound for the price of a large animal may seem insignificant, but “live weight” sales of cows compound through processing: Only about a third of the beef makes it into human larders. Additional impacts on the consumer’s price tag include costs of slaughter, processing, packaging, and distribution. All of these have inflated, but beef prices are poised to bloat further.

Those pennies add up very quickly. Live beef prices were $1.62/pound for cattle on December 7, climbing nearly 5% to $1.70 on January 8, and 11.7% by February 2, when the market closed at $1.81. This is merely six pennies away from last November’s $1.87 per pound, the highest price for beef in US history. Moreover, the latest jump represented four cents (2.47%) in two days: If such beef inflation persisted, the live weight of a cow in a year would approach $9 per pound. That seemingly small increment in live animal prices thus signals a powerful market move.

Where’s the Beef?

(Photo by Ben Hasty/MediaNews Group/Reading Eagle via Getty Images)

Like all commodity markets, beef prices are subject to various factors, and price shocks can occur due to disease, environmental factors, geopolitical turmoil, sharp shifts in consumer demand, or international trade agreements. Underlying these variables in 2024 are somewhat novel industry conditions that relate to herd size, drought, and economics. America is literally short of cows. These agricultural realities promise sustained high beef prices through 2024 and 2025.

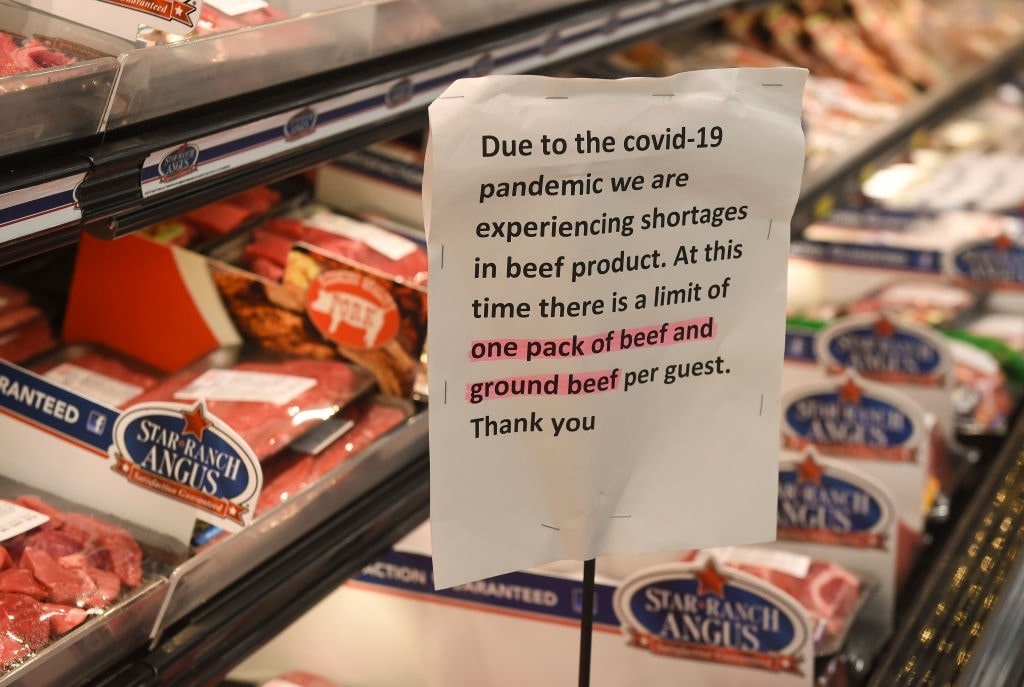

During COVID-19, many US beef slaughter and processing facilities shut down, backing up inventories of American beef that needed to be processed. A crushing drought at the same time drove up feed prices, withered pastures (requiring the purchase of yet more pricey feed), strained animals, and dried-up water supplies. Many farms had to get rid of cows and other livestock prematurely even as they plowed wilted feed crops into the ground. Texas farmers sold off an estimated 50% of the state’s cow herds in 2022; New Mexico reportedly reduced herd size by 43% and Oregon by 41%. Many farmers around the nation simply sold up and stopped rearing cows.

The US Department of Agriculture (USDA) reports that America’s beef herd numbers are now lower than they have been in 50 years. These modern cows boast improved genetics over the animals of the past due to selective breeding, offering significantly higher slaughter weights. However, the dramatic reduction of US cow numbers will not be rebuilt without a short-term leap in prices.

Meat Alternatives

(Photo by: Edwin Remsberg/VW Pics/Universal Images Group via Getty Images)

Chickens for the American dinner table can be raised from chick to plate in a matter of a few months, and hens lay eggs nearly daily. Pigs yield large litters twice annually, and their young are raised for market in four to five months. Sheep generally deliver twins or triplets, ready to eat in four months to a year. Cows are very different animals, and their flesh cannot be accelerated to market like manufactured goods when consumer demand increases.

A cow’s gestation period is 285 days (nine and a half months) compared to a pig’s 114 days and a sheep’s 147 days. Cows rarely have twins, and that single calf for meat will take two years on grain to raise to slaughter weight, adding another six months for grass-fed. Drastic shocks to beef ranching thus require a longer time for rebound than other livestock farming, and this shock has been drastic. As prices rise, farmers will hold back cows and heifers (young female calves) for future breeding programs as they have already lost breeding stock. New market entrants will seek breeder cows, while many consumers eyeing nosebleed steak prices will seek an animal to fence into a few acres for their own use if they have the space. Meanwhile, strong milk prices mean fewer dairy farm culls for the meat packer.

Demands for replacement breeding stock will thus compound beef price increases. But cows are food, and Americans have a thing for their burgers and fries. They will keep paying the higher prices.

Outlook 2024

Many variables still bear on the future of beef prices. The USDA intends to open US beef markets to Paraguayan cows, which could help or hurt, depending on whether the dreaded hoof-and-mouth disease infects US herds via the Paraguayan animals. Mild winter weather would help fatten cows and reduce feed costs. Conversely, brutal cold snaps deter weight gain and increase input costs. The colder it gets, the more cows eat and the harder it is for them to maintain their condition.

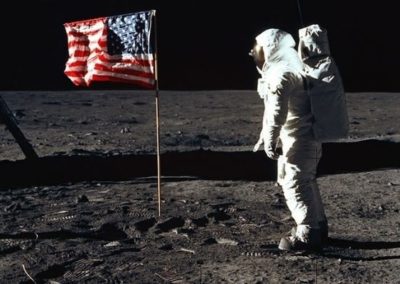

Amid these unforeseeable variables remains a predictable shortage of animals that will persist as ranchers scramble to meet consumer demands for quality beef products. Consumers will not be over the moon at the news, but hamburger is likely to remain pricey until the cows come home.