What Was the Nixon Shock?

Nixon shocked the economy 50 years ago – and it hasn’t been the same since.

By: Andrew Moran | May 11, 2021 | 542 Words

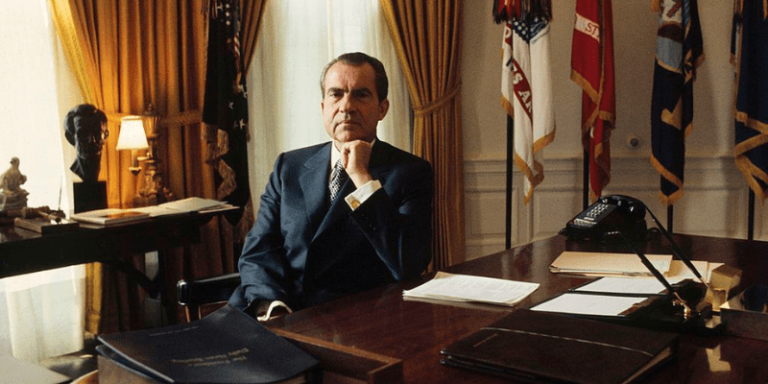

Richard Nixon (Photo by Don Carl STEFFEN/Gamma-Rapho via Getty Images)

Fifty years ago, President Richard Nixon forever changed the United States and international financial systems. U.S. economic conditions in 1971 were not great. The national unemployment rate topped 6%, money supply growth exceeded 10%, and the inflation rate was 4.38%. Over two days, officials had put together a proposal to lift the U.S. economy from stagnation, spawned by the overheating that took place in the 1960s.

Here is what President Nixon announced on Aug. 15, 1971:

- A 90-day freeze on prices and wages for the first time since the Second World War.

- A 10% surcharge on all imports subject to duty to keep U.S. products competitive in the international market.

- Suspend the dollar’s convertibility into gold and closing the gold window that prevented foreign governments from exchanging their dollars for the yellow metal.

He outlined these policy mechanisms on television, telling the American people that his new economic policy would “create a new prosperity without war.”

“The third indispensable element in building the new prosperity is closely related to creating new jobs and halting inflation. We must protect the position of the American dollar as a pillar of monetary stability around the world.

In the past 7 years, there has been an average of one international monetary crisis every year …

The effect of this action, in other words, will be to stabilize the dollar.”

Initially, the Nixon Shock had been a political and financial success, but years later, there is a widespread dispute over its effectiveness.

The End of Bretton Woods

Following the Second World War, the U.S., Canada, Western European countries, Australia, and Japan established the Bretton Woods System. This was the first time in history that each nation was required to adopt a monetary policy that ensured the exchange rate of its currency was within a fixed value in terms of gold. Essentially, buying the currency would decrease the supply of the currency and increase its value. If the price surged too much, the central bank would turn on the printing press.

(Photo by Alex Wong/Getty Images)

The Nixon Shock had collapsed the Bretton Woods system overnight, essentially meaning that the U.S. dollar became a fiat currency (backed by nothing). This led to other currencies, including the British pound sterling, to become free-floating in the global marketplace. It led to chaos. As a result, economists continue to debate the effects and merits of Nixon’s economic doctrine.

Fiat Money 50 Years Later

Nixon had sold the world on fiat money, ridding every economy of any connection to currencies supported by gold. Today, all major government-issued currencies are not backed by anything, giving central banks enormous power during the booms and busts phases of the economy. Conservative and libertarian economists and policy analysts talk about the possibility or need of adopting an asset-backed currency, whether it is gold or silver. However, the likelihood of transitioning to a dollar that is backed by anything is quite low. There is little appetite to change monetary policy in such an incredible manner in the federal government and Federal Reserve since officials possess enormous power and influence.

What was meant to be a temporary policy maneuver by the 37th president quickly became a permanent part of international relations.